Key Findings

As part of our most recent global consumer study, we asked nearly 24,000 consumers from 23 countries which of six channels (chat with an automated system, self-service on mobile, self-service on computer, chat with a person on computer, talk with someone on the phone, or meet with someone in person) they would prefer to use to complete nine common interactions. We also asked which elements of an experience they considered most important when using each of these channels. From their responses, we found that:

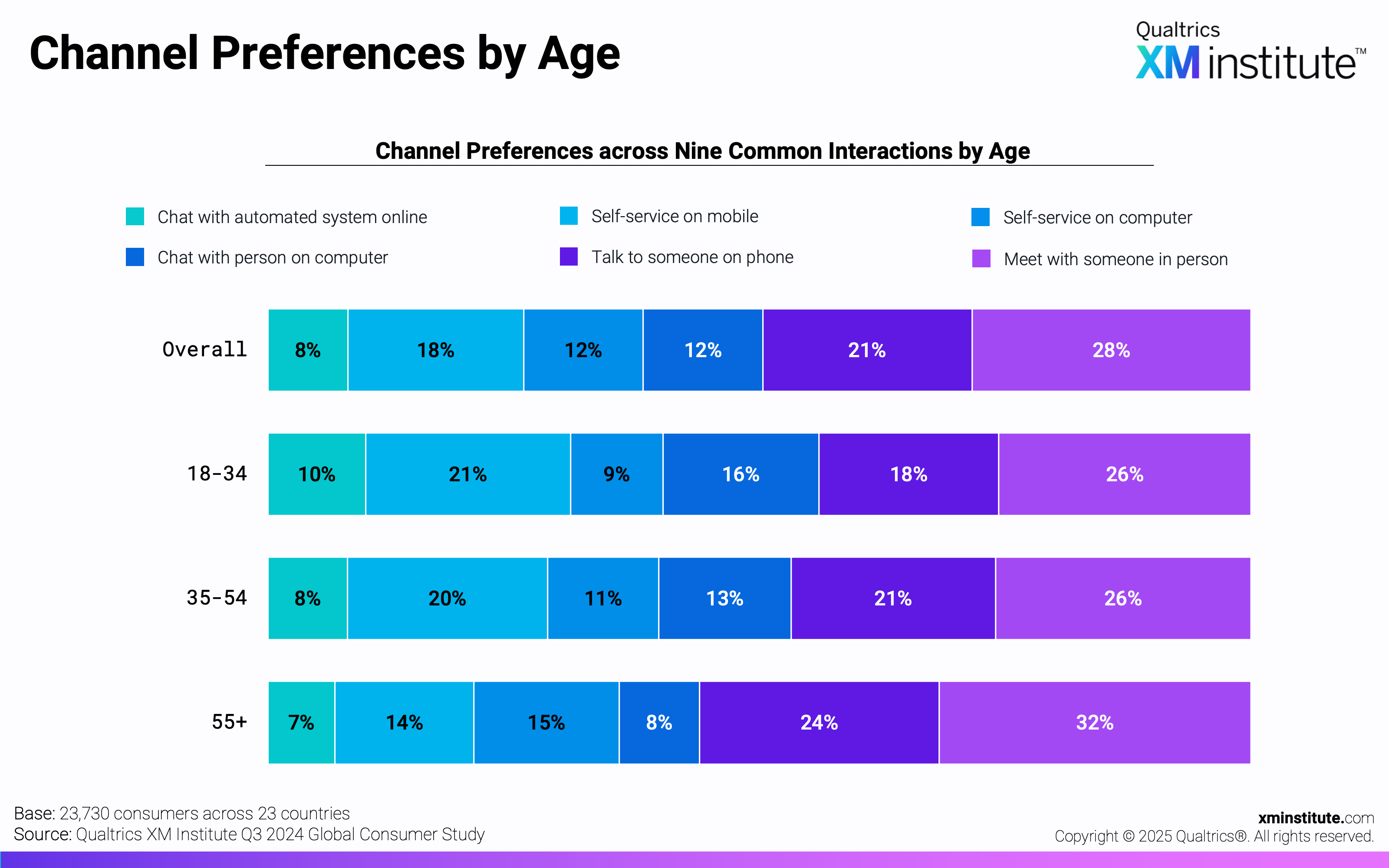

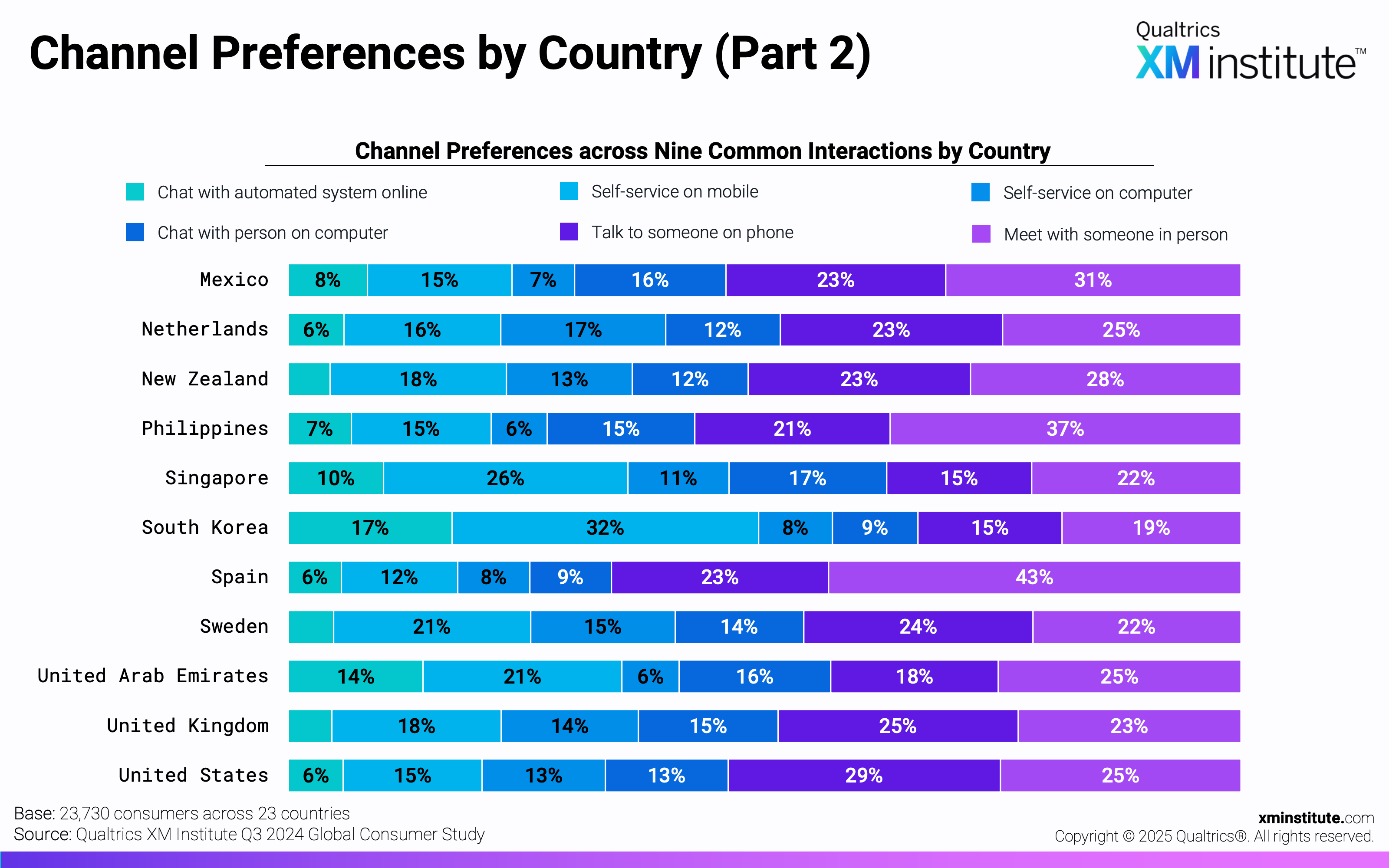

- Consumers prefer human channels. On average across all countries and activities, 61% of consumers prefer using one of three human-mediated channels (chat with a person on a computer, talk with someone on the phone, or meet with someone in person). This preference is strongest among older (55+) consumers and Spanish consumers.

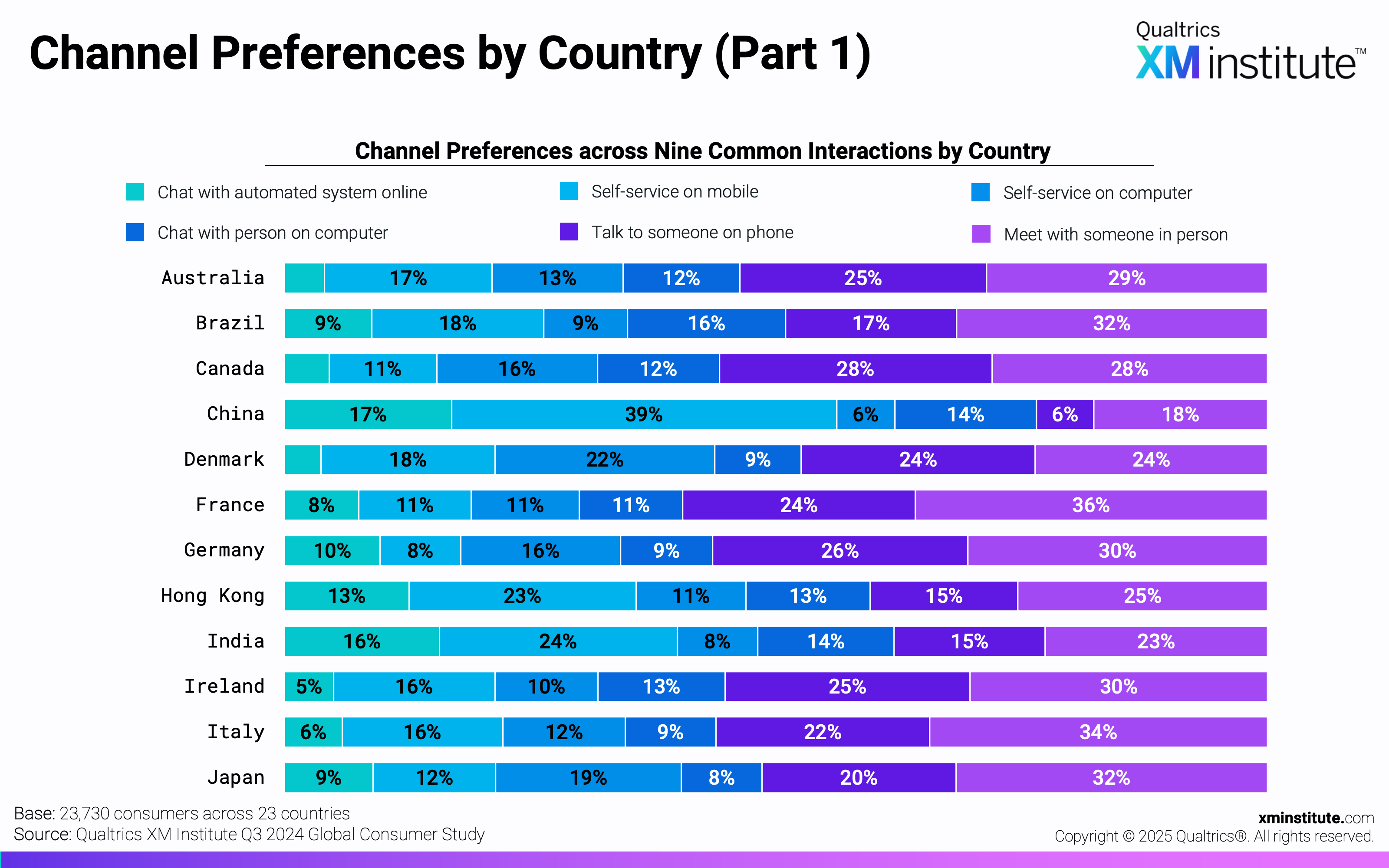

- Digital channels are most popular among Asian consumers. Across all activities, digital channels (self-service and chat with an automated system) are most popular among Chinese (62%), South Korean (57%), Indian (48%), and Hong Kongese (47%) consumers.

- Chatbots are the least popular. Consumers are least likely to prefer using chat with an automated system. Only 8% on average would prefer to use this channel to complete nine common interactions. This channel is most popular for consumers looking to get status on an order (12%) and book an airline ticket (10%).

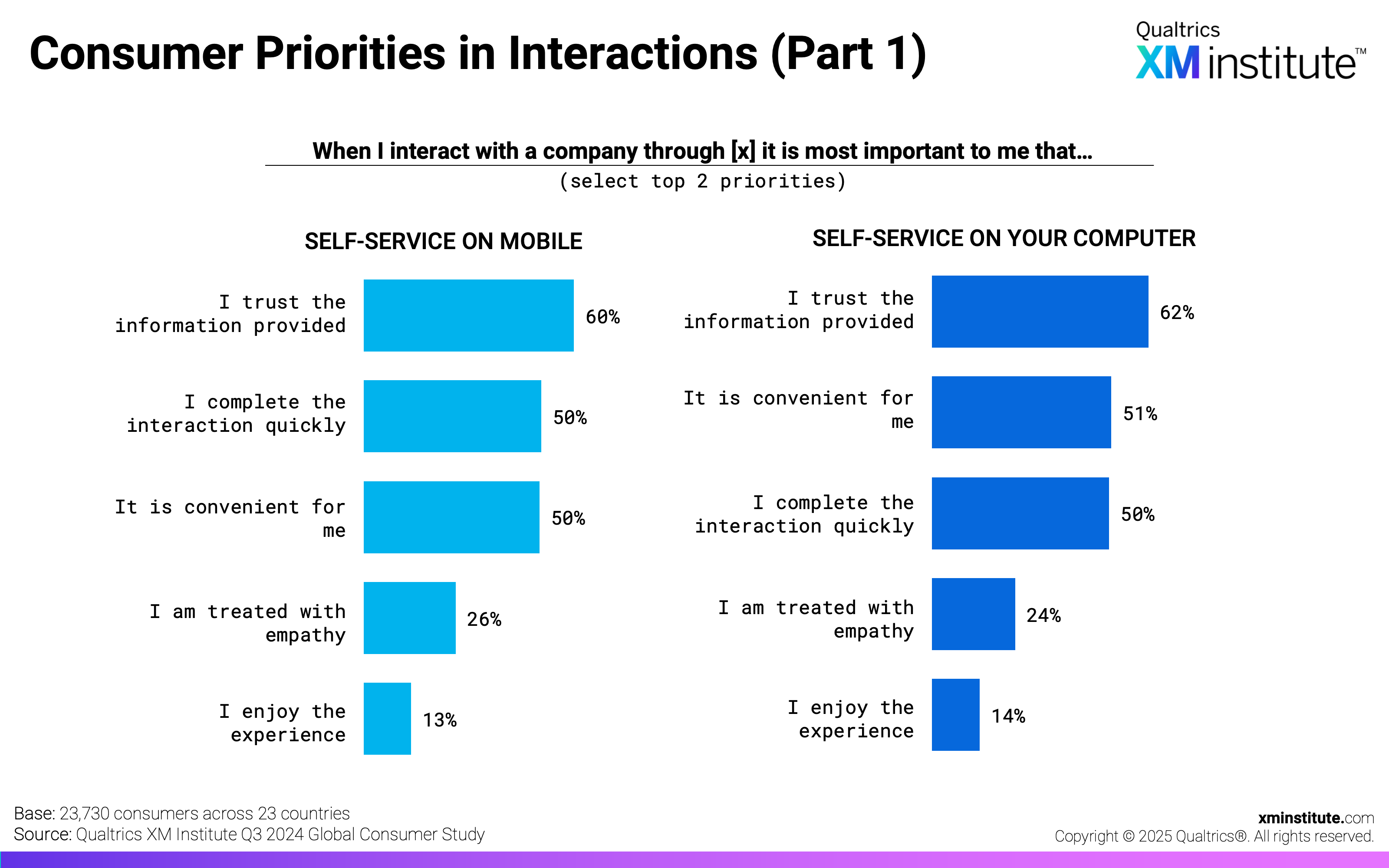

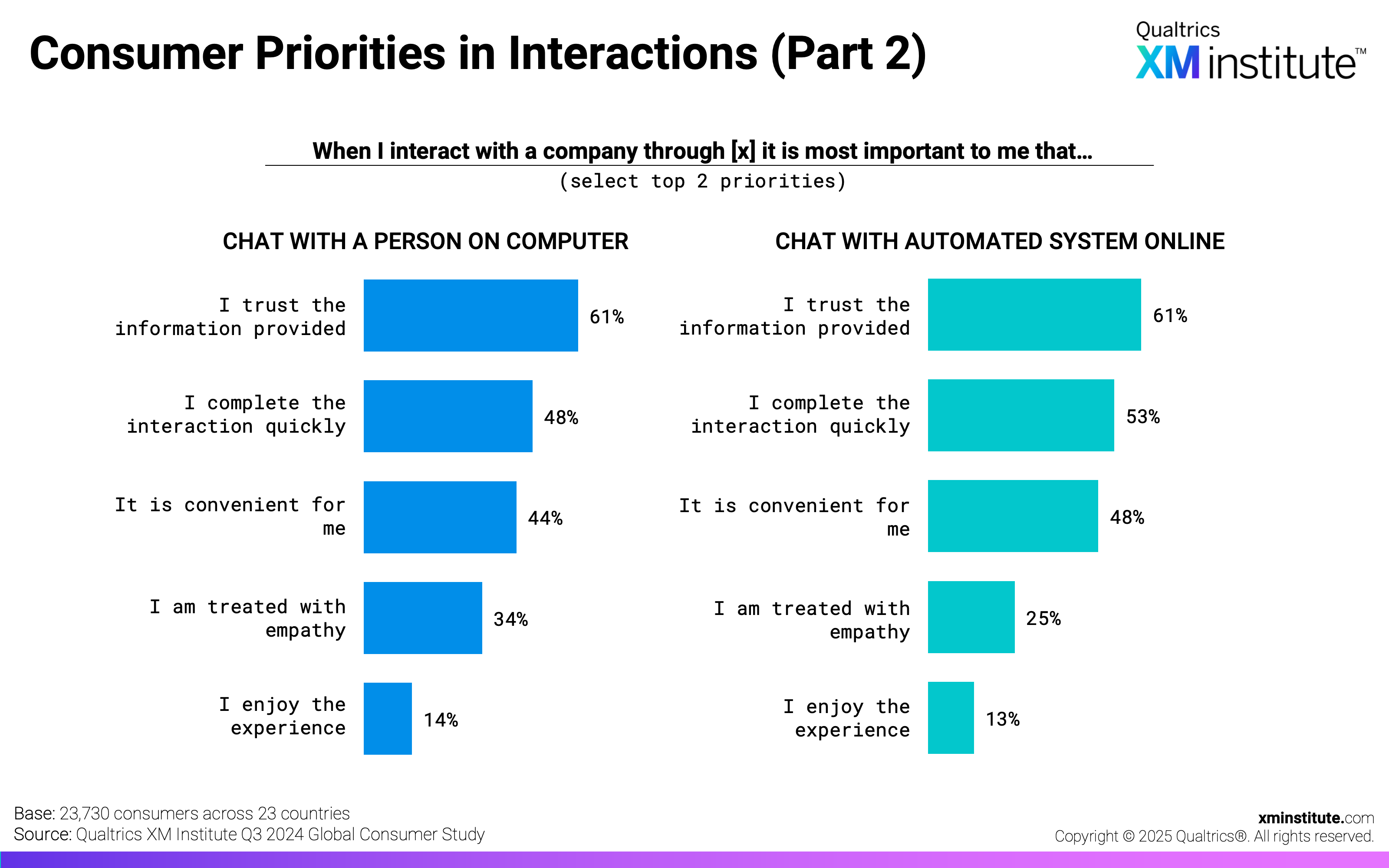

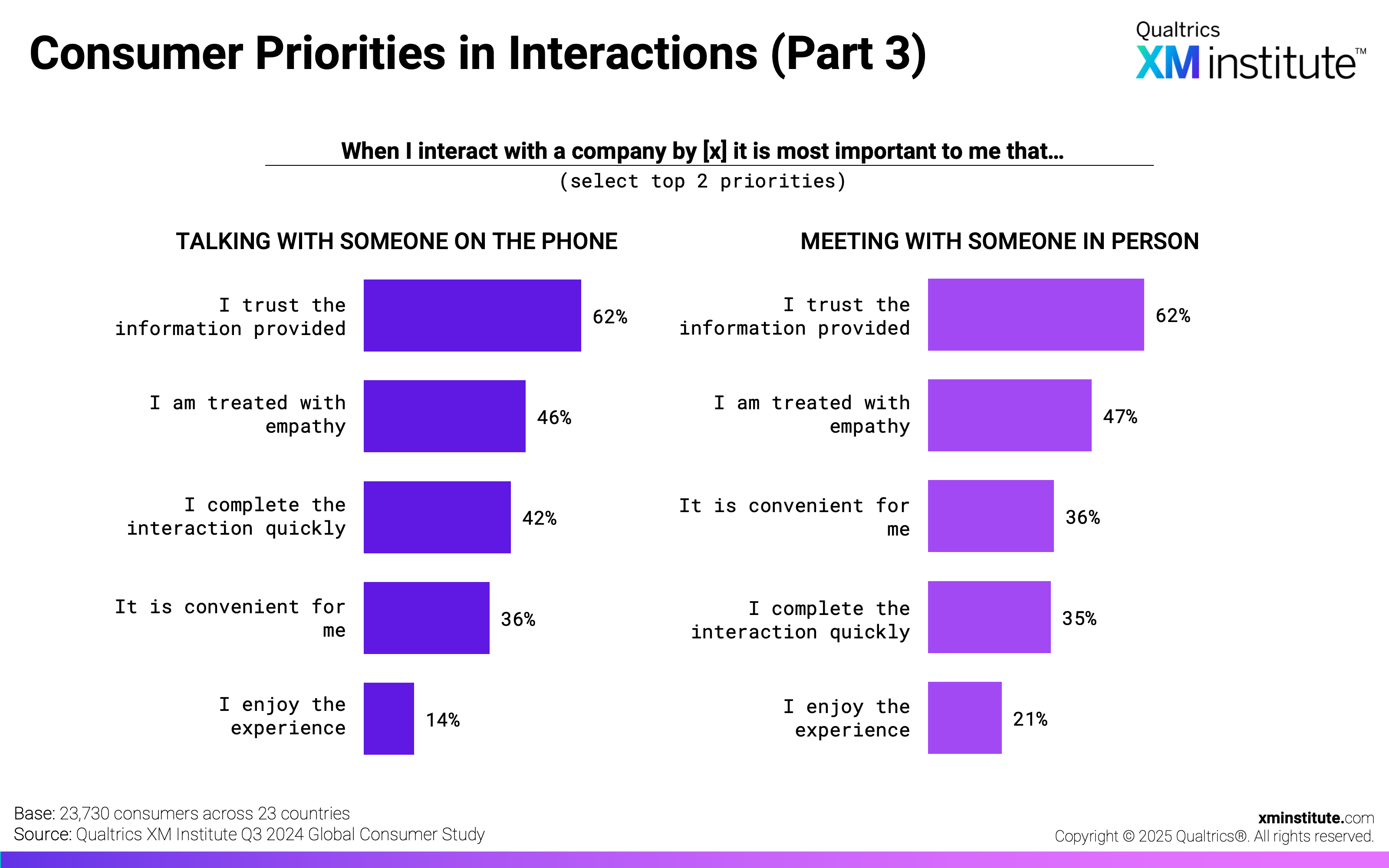

- Consumers prioritize trust in their interaction channels. Consumers did not deviate significantly when prioritizing the top two elements of channel experiences: I trust the information provided was the most important priority across all channels, followed by speed: I complete the interaction quickly.

- Empathy is a top priority in human channels. When interacting with a company over the phone or in person, I am treated with empathy becomes consumers’ #2 priority, ranking above speed and convenience, compared to the #4 priority during digital interactions (self-service, chat).

Figures

Here are the figures in this report:

- Channel Preferences by Age (see Figure 1)

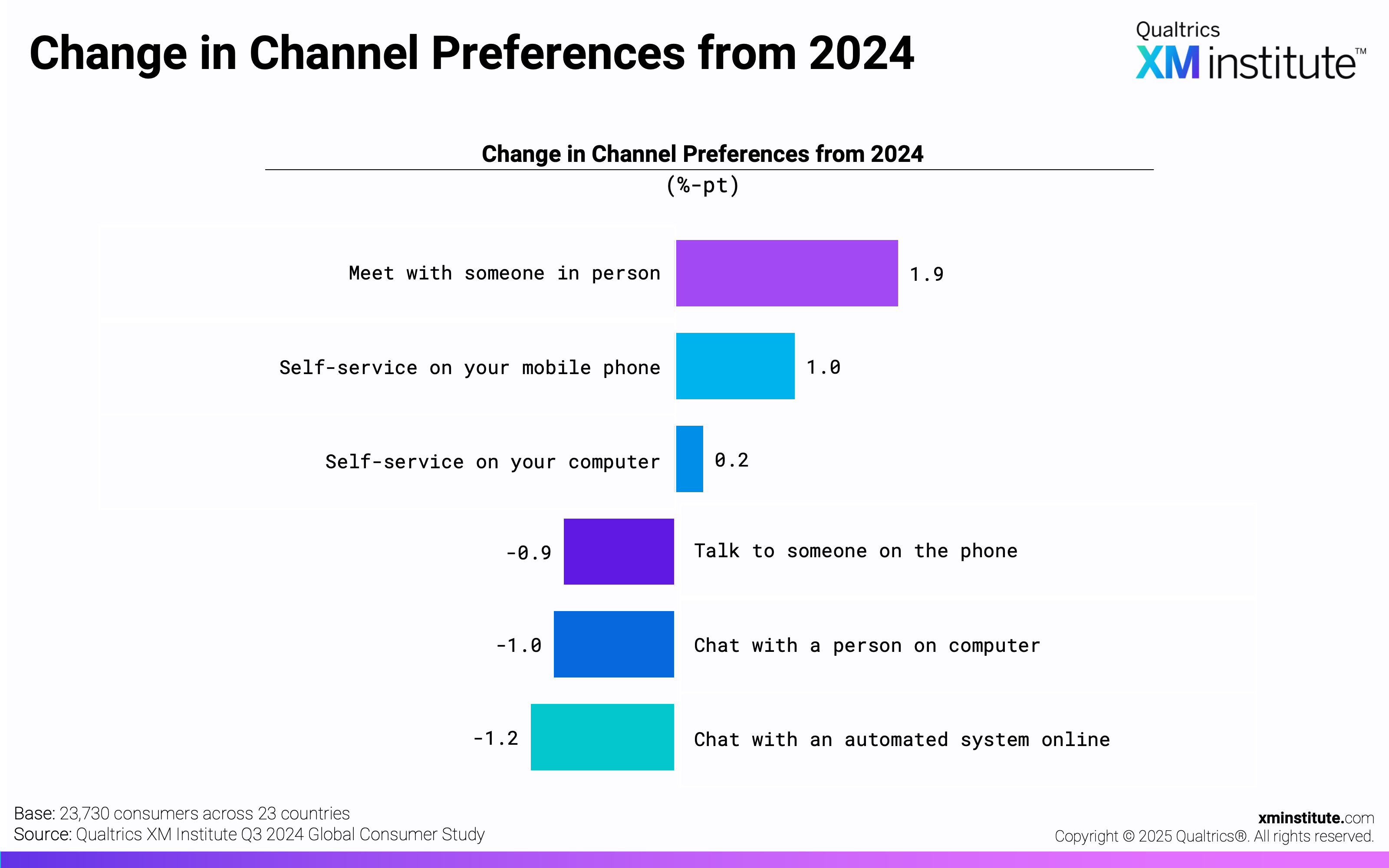

- Change in Channel Preferences from 2025 (see Figure 2)

- Channel Preferences by Country (Part 1) (see Figure 3)

- Channel Preferences by Country (Part 2) (see Figure 4)

- Consumer Priorities in Interactions (Part 1) (see Figure 5)

- Consumer Priorities in Interactions (Part 2) (see Figure 6)

- Consumer Priorities in Interactions (Part 3) (see Figure 7)

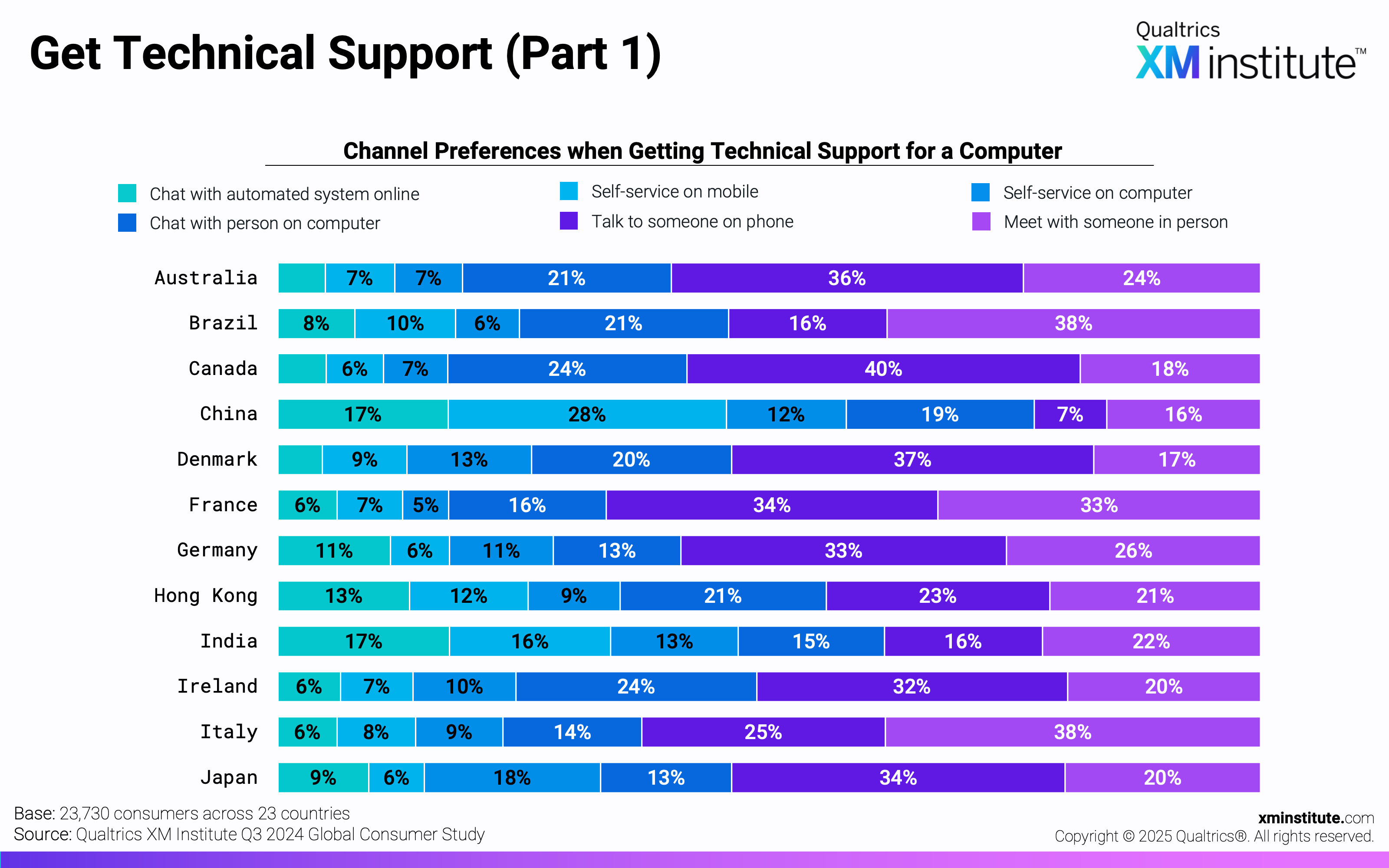

- Get Technical Support (Part 1) (see Figure 8)

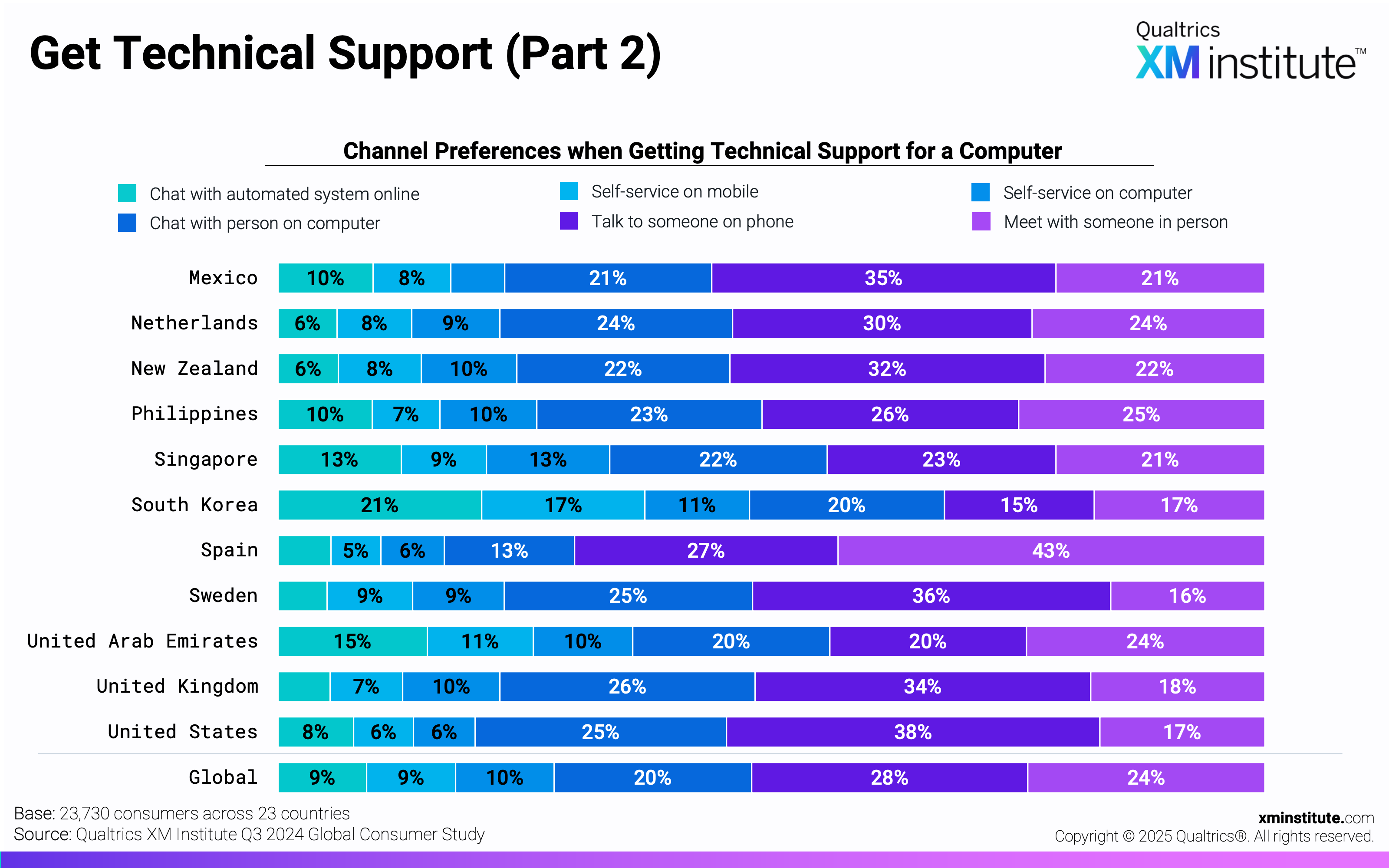

- Get Technical Support (Part 2) (see Figure 9)

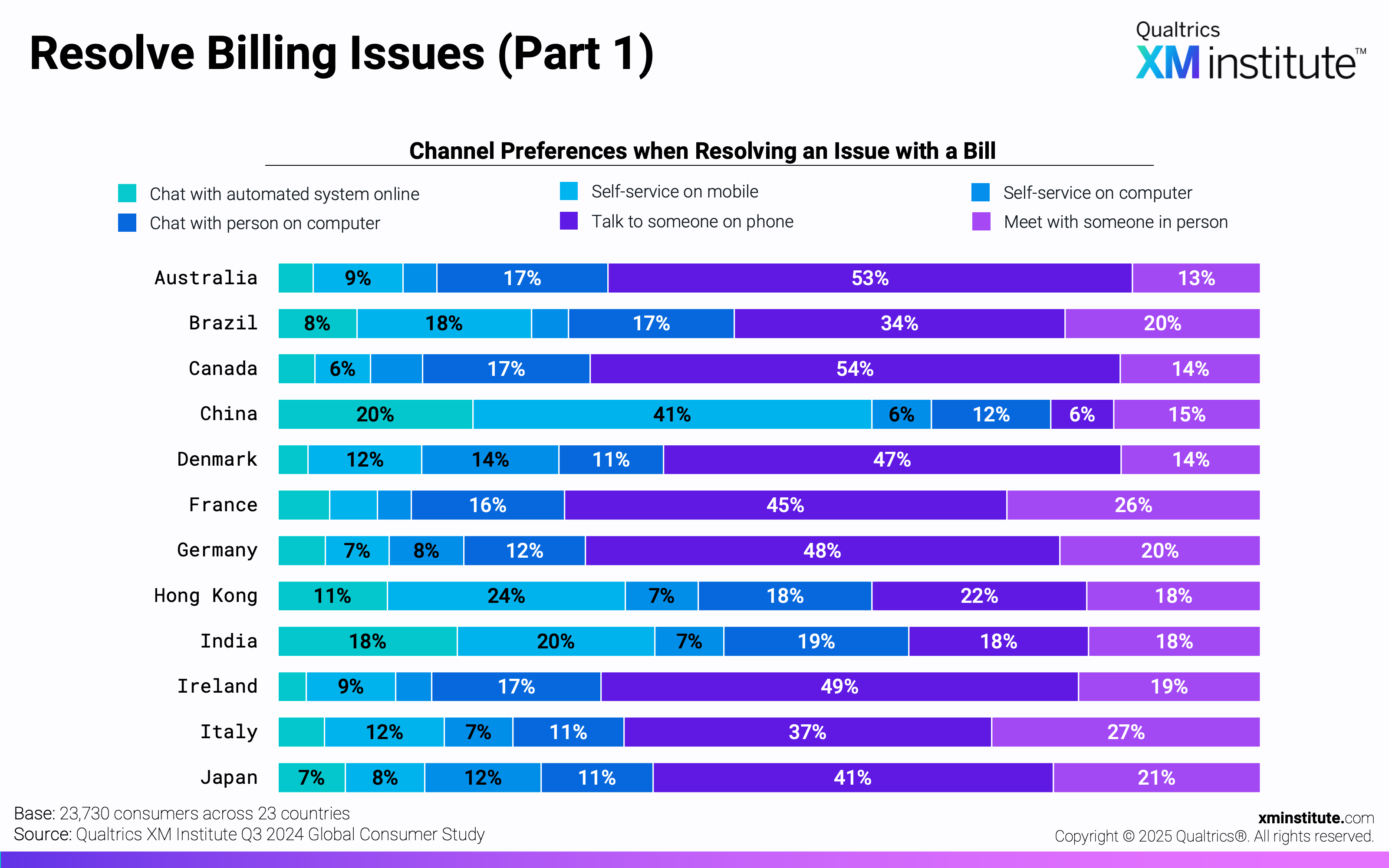

- Resolve Billing Issues (Part 1) (see Figure 10)

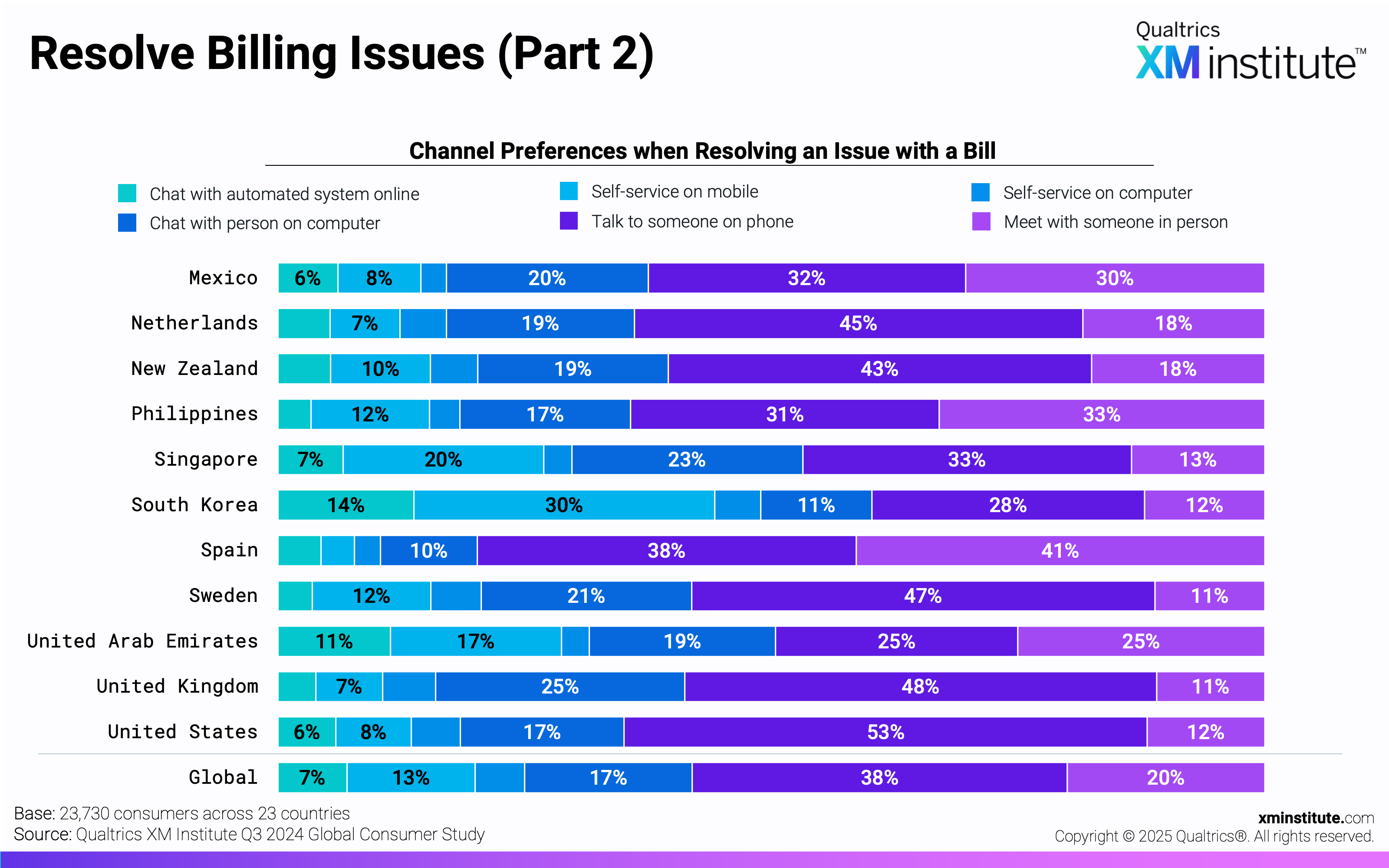

- Resolve Billing Issues (Part 2) (see Figure 11)

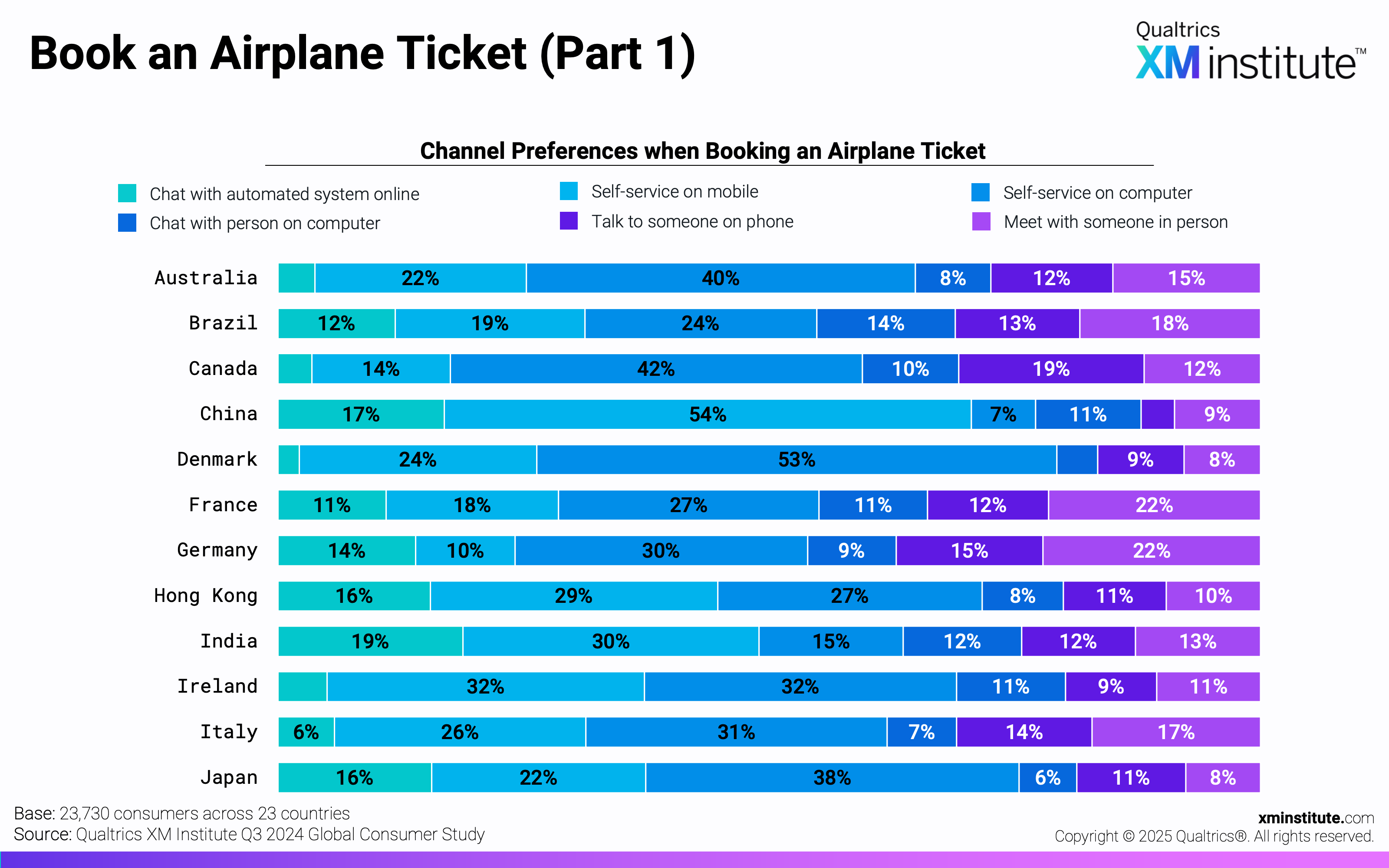

- Book an Airplane Ticket (Part 1) (see Figure 12)

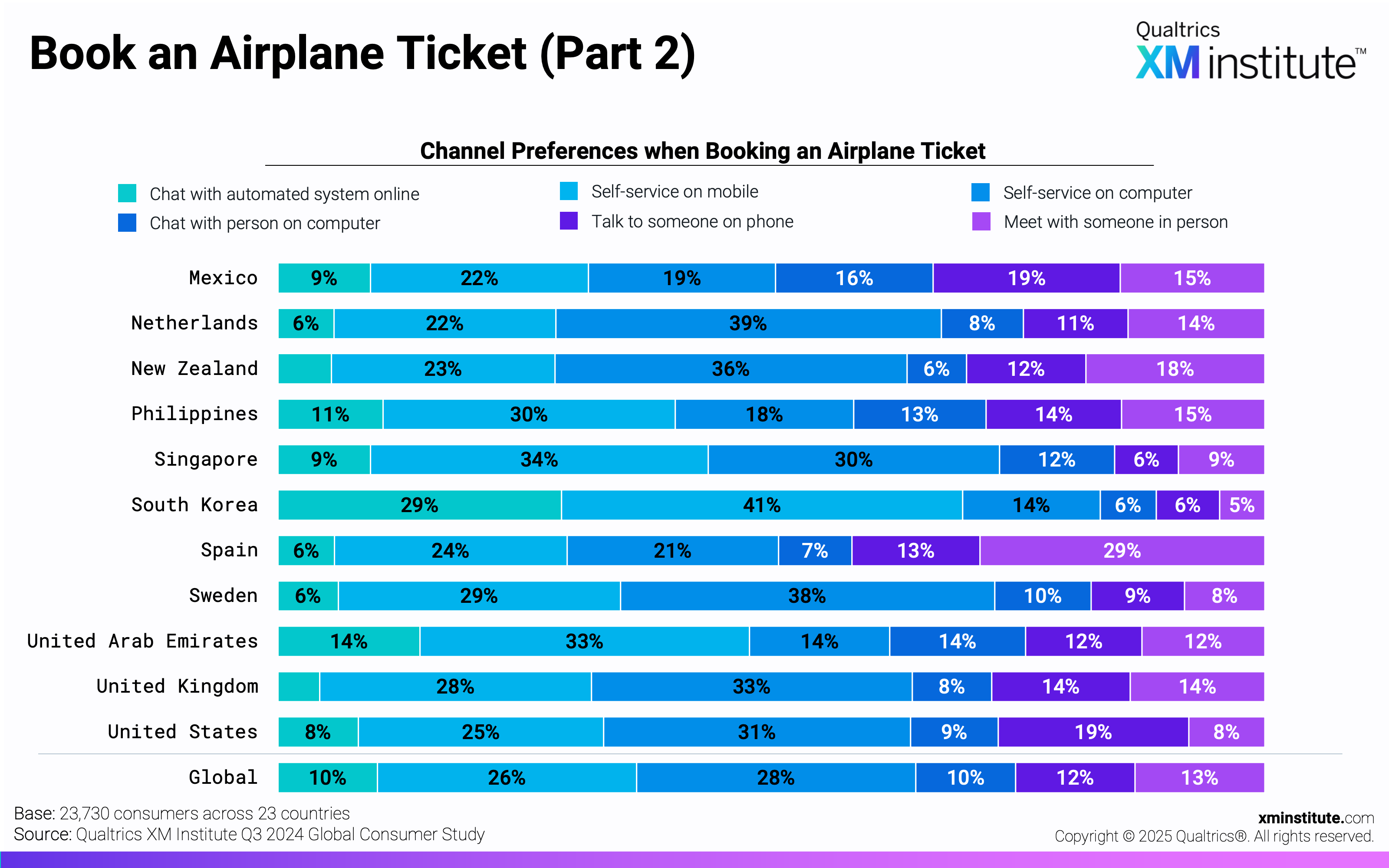

- Book an Airplane Ticket (Part 2) (see Figure 13)

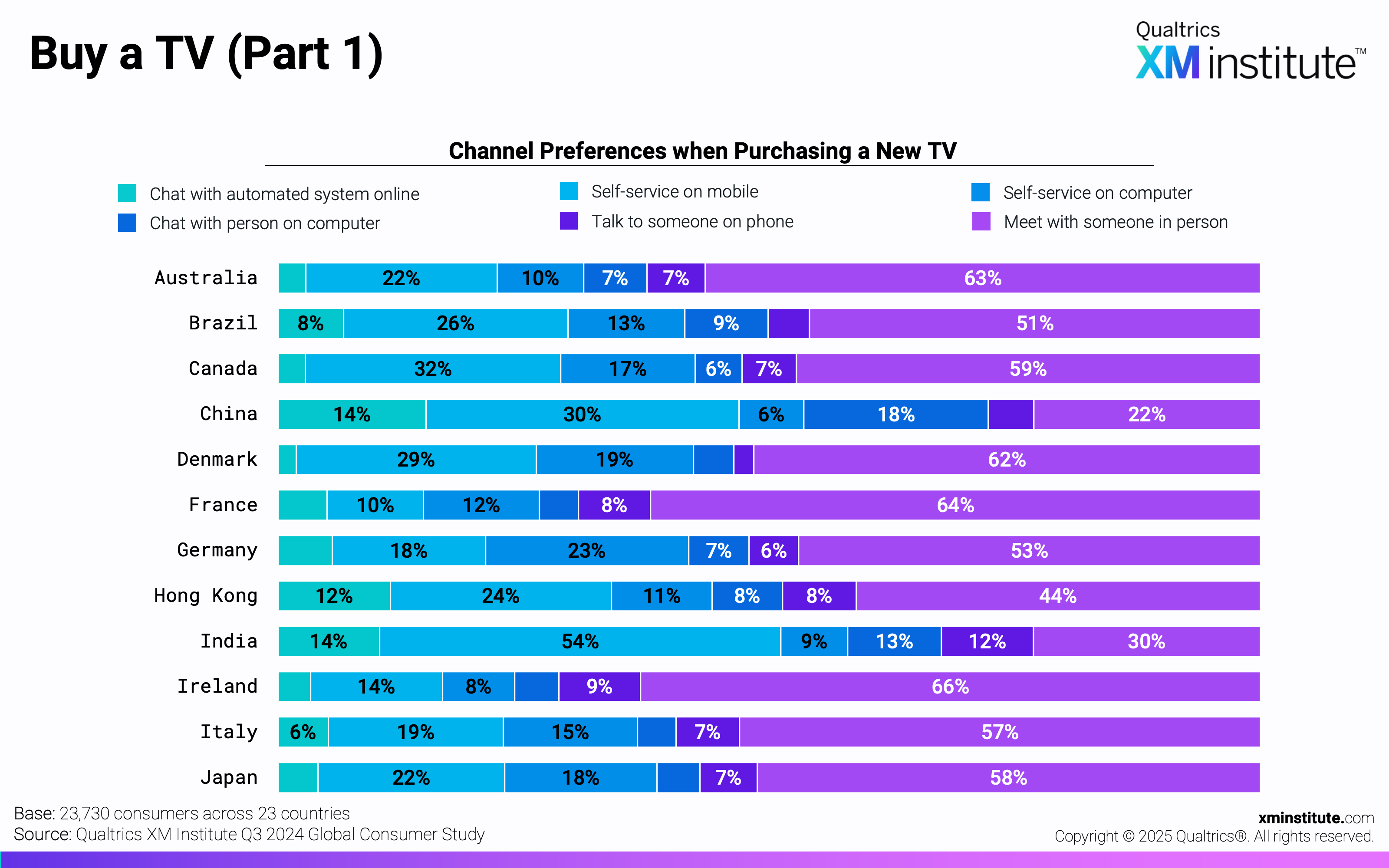

- Buy a TV (Part 1) (see Figure 14)

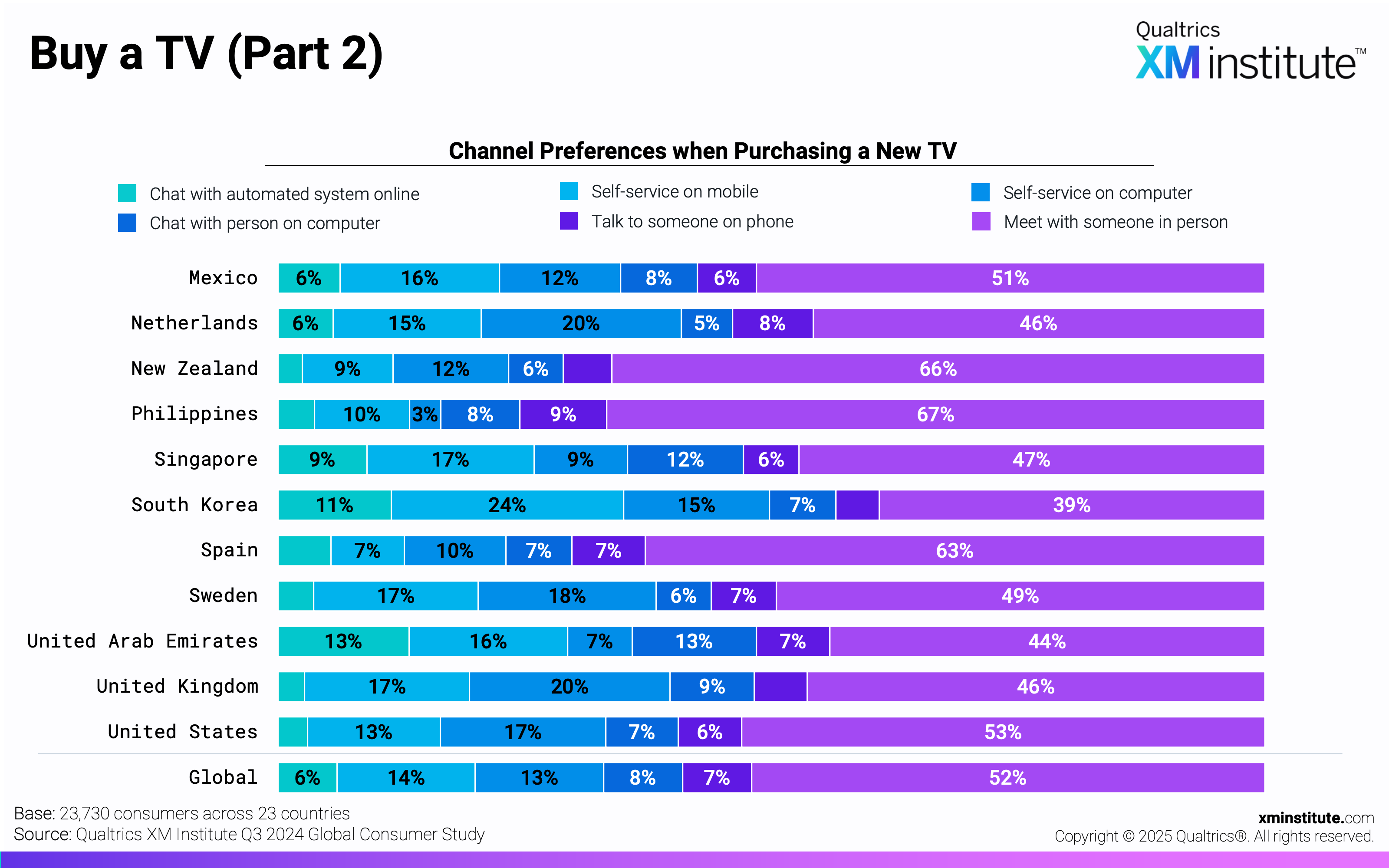

- Buy a TV (Part 2) (see Figure 15)

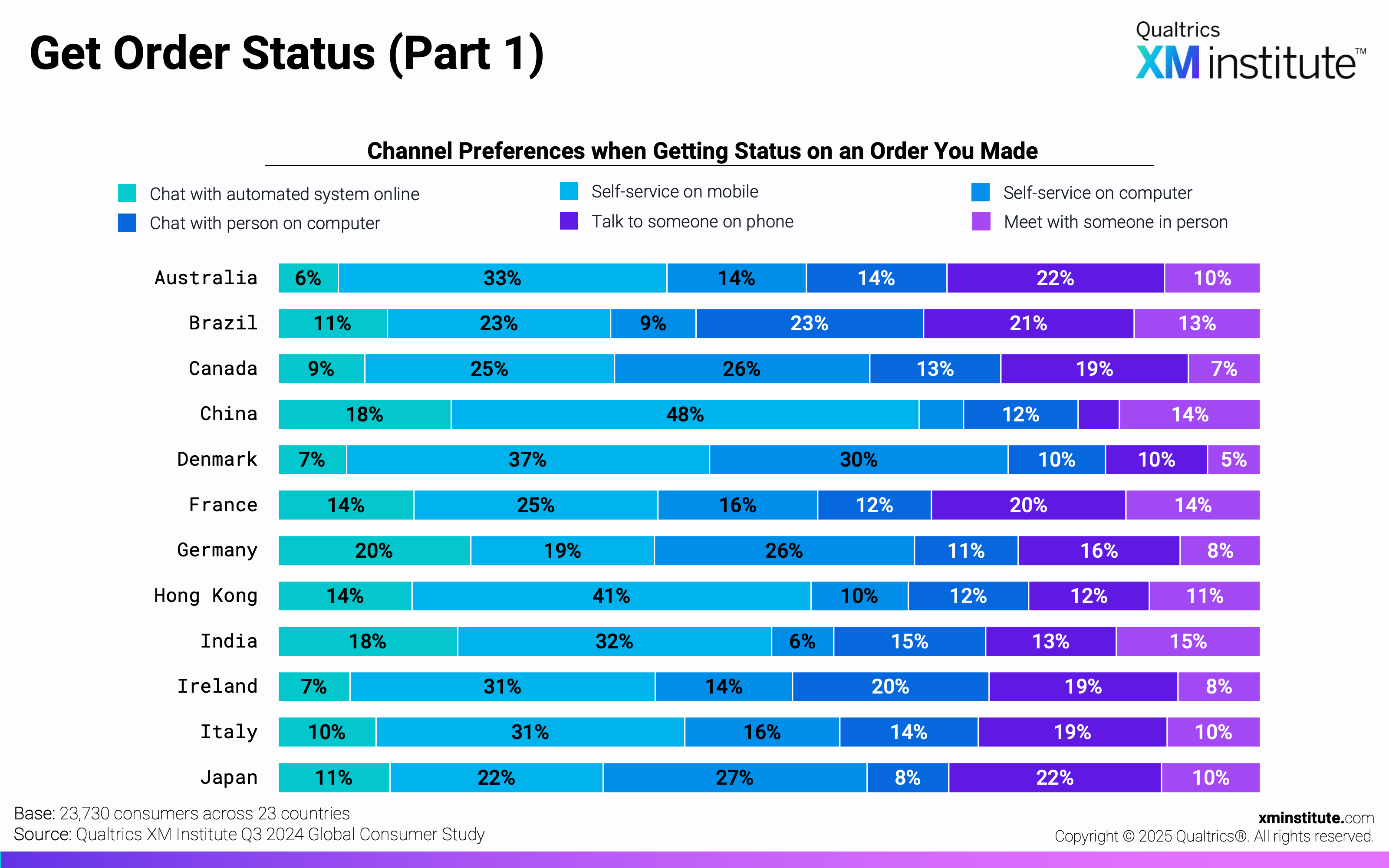

- Get Order Status (Part 1) (see Figure 16)

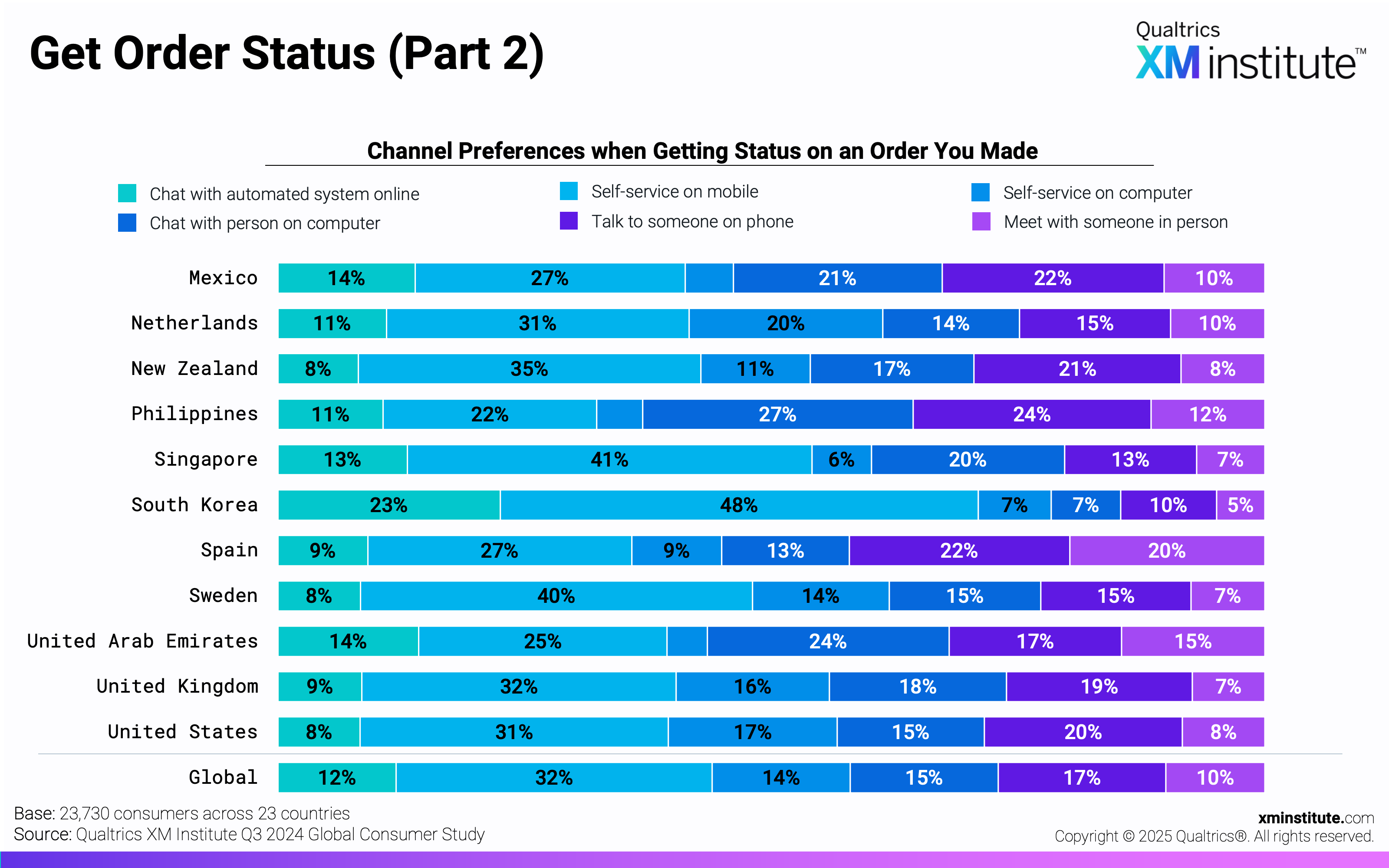

- Get Order Status (Part 2) (see Figure 17)

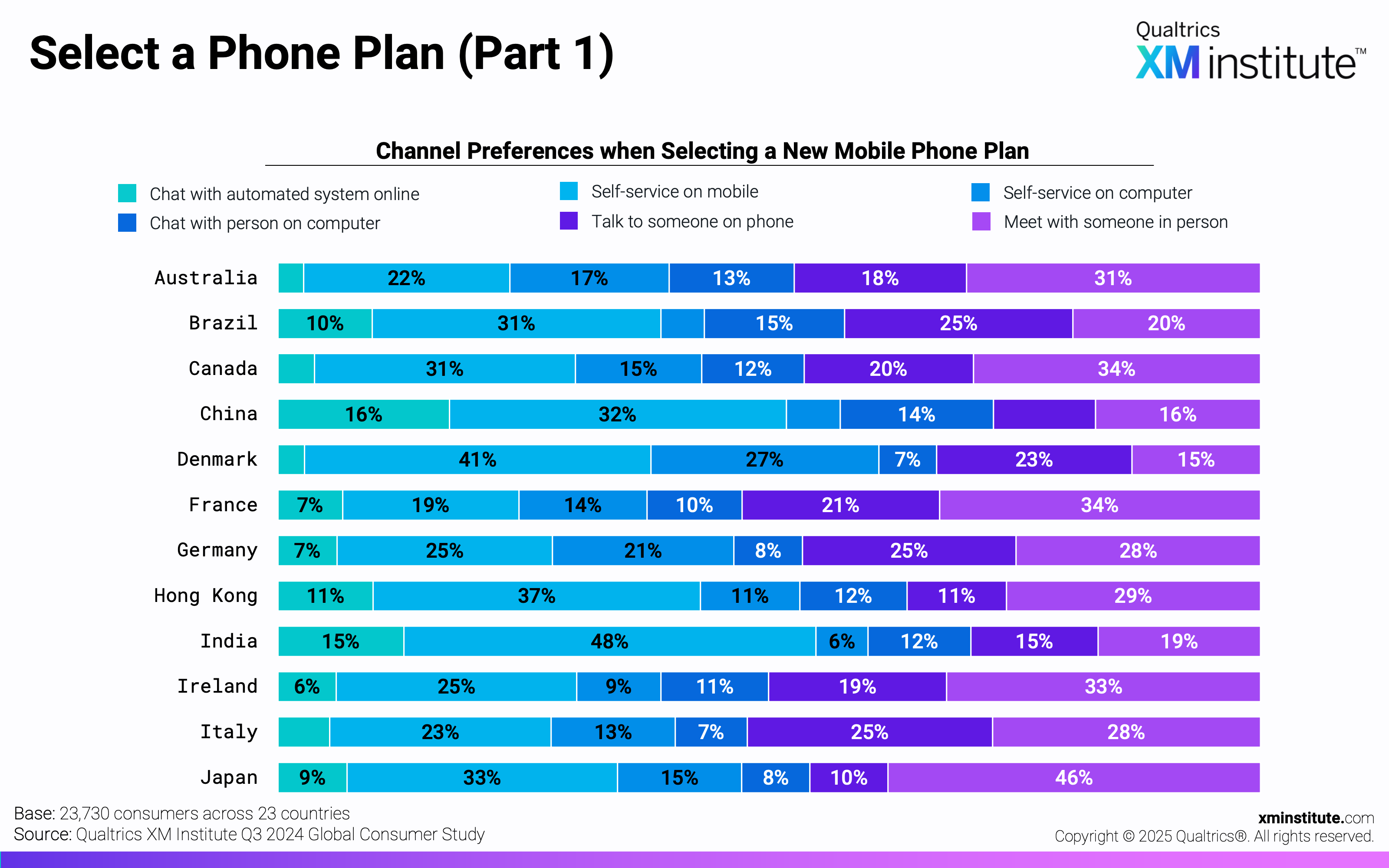

- Select a Phone Plan (Part 1) (see Figure 18)

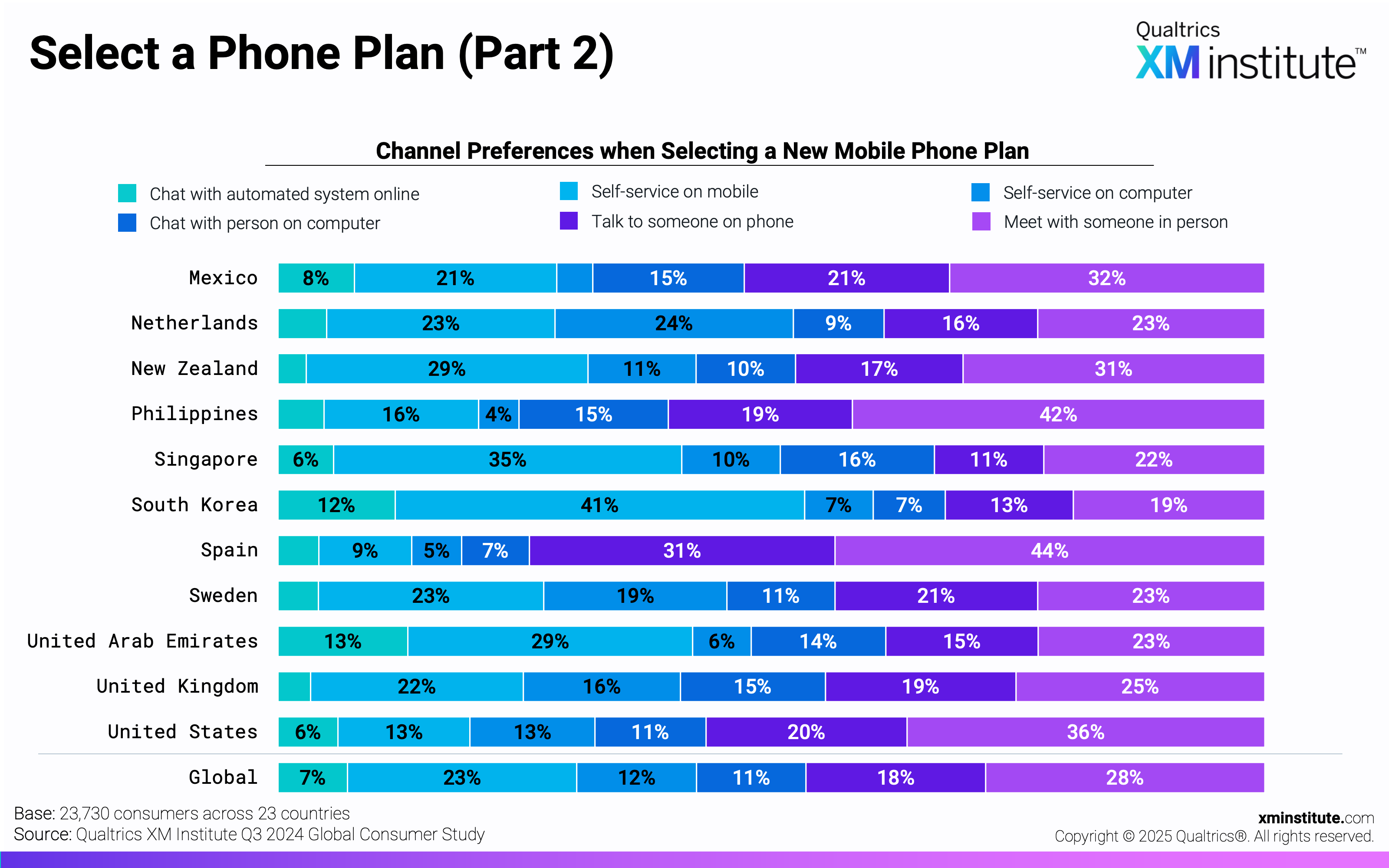

- Select a Phone Plan (Part 2) (see Figure 19)

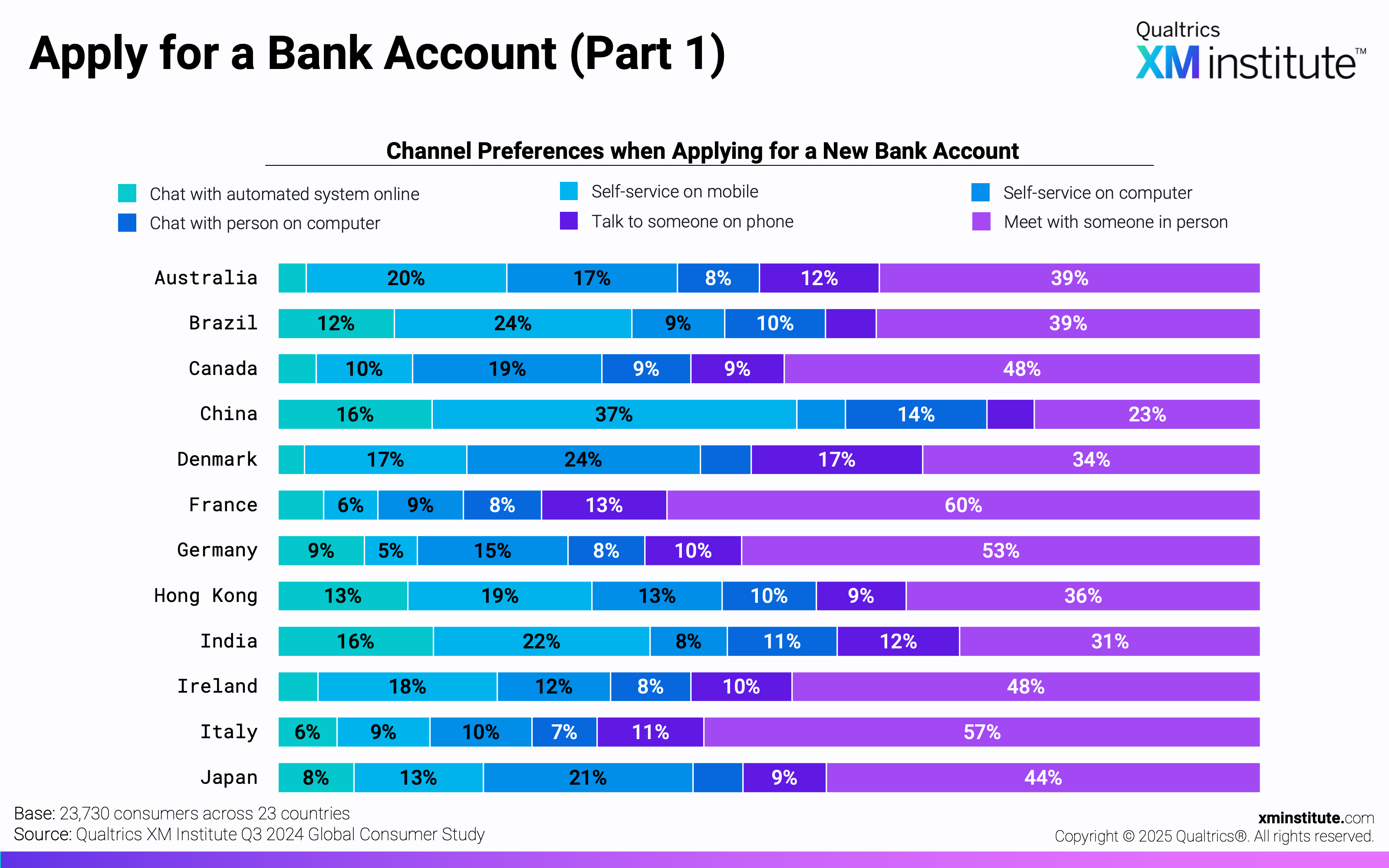

- Apply for a Bank Account (Part 1) (see Figure 20)

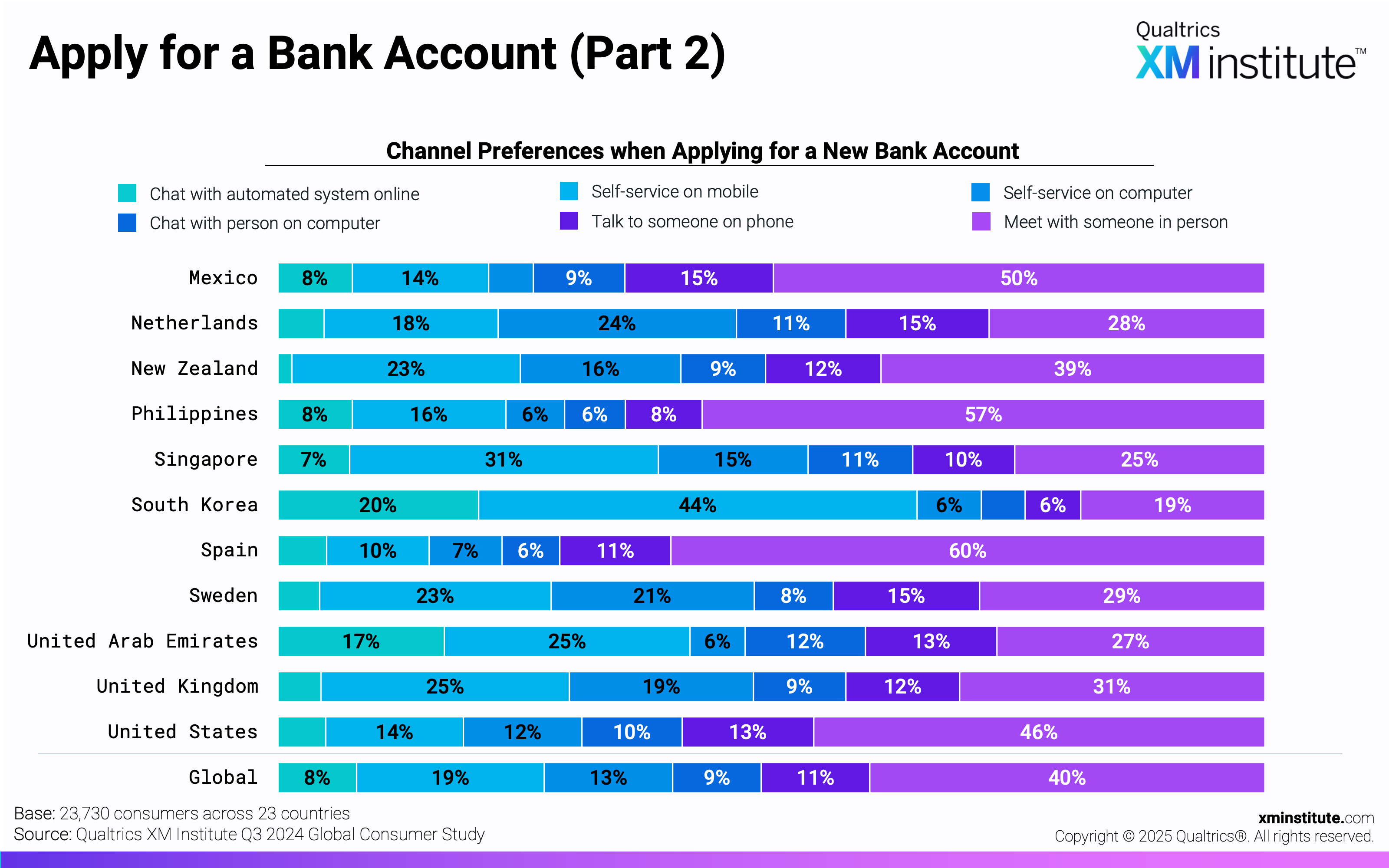

- Apply for a Bank Account (Part 2) (see Figure 21)

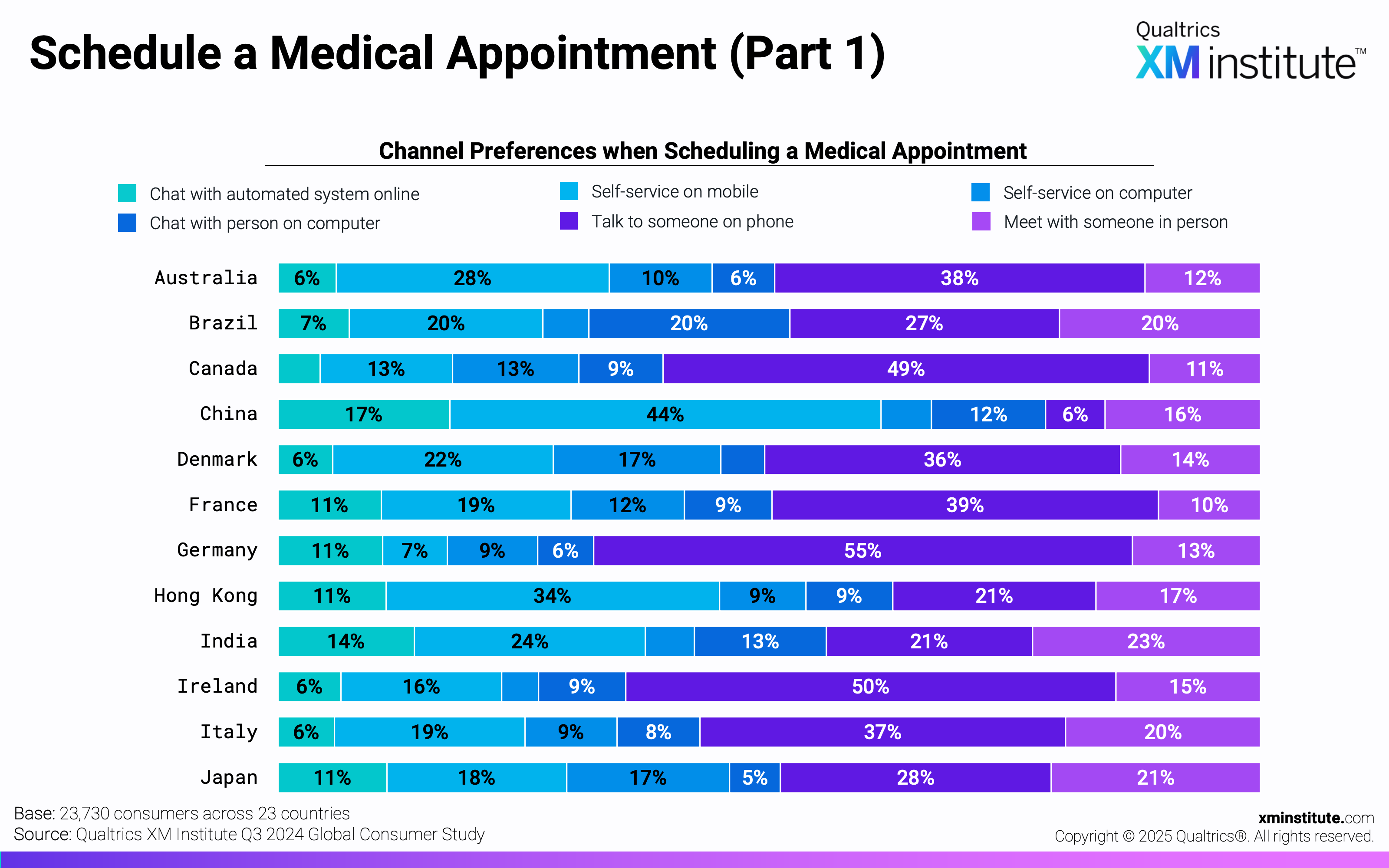

- Schedule a Medical Appointment (Part 1) (see Figure 22)

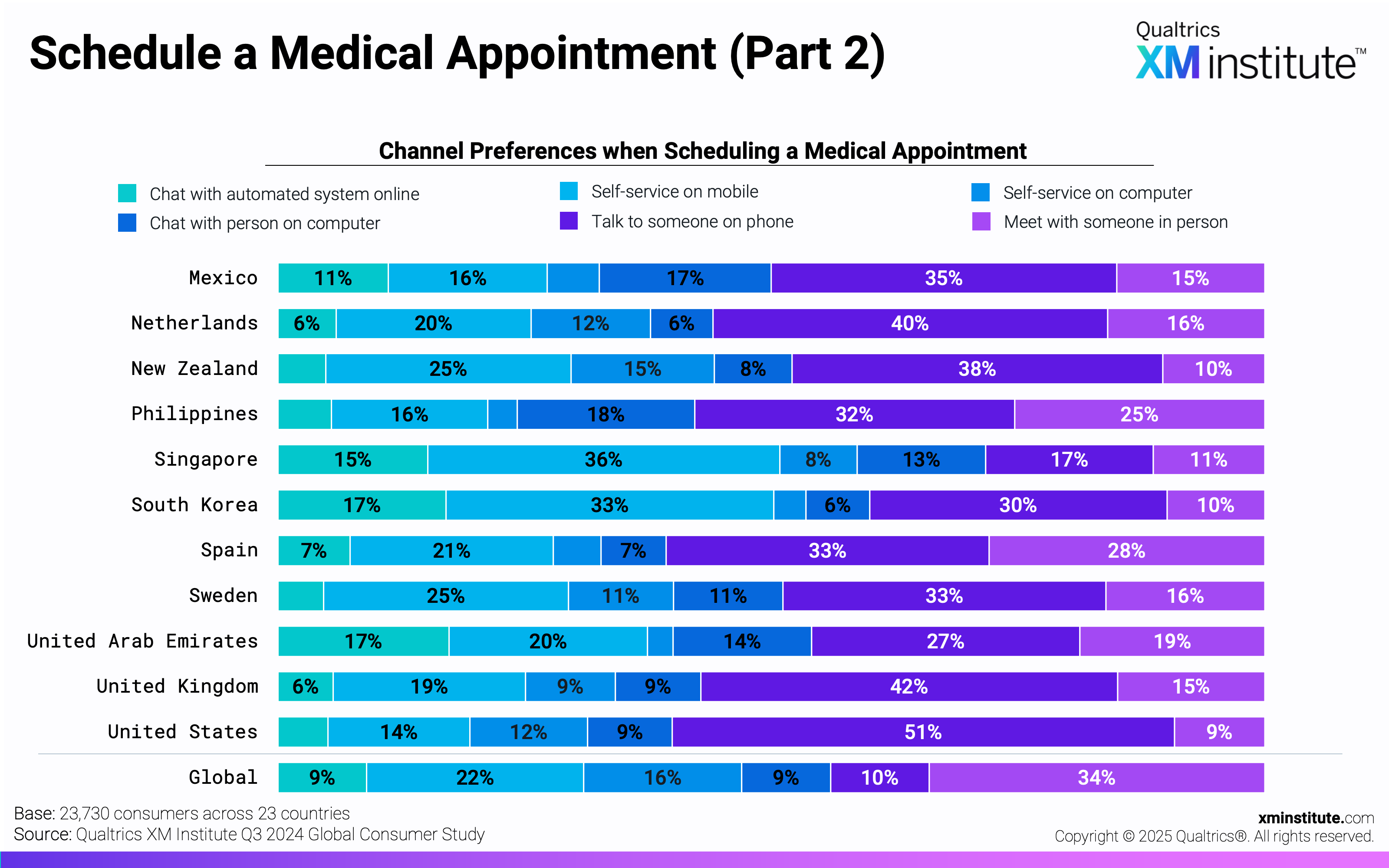

- Schedule a Medical Appointment (Part 2) (see Figure 23)

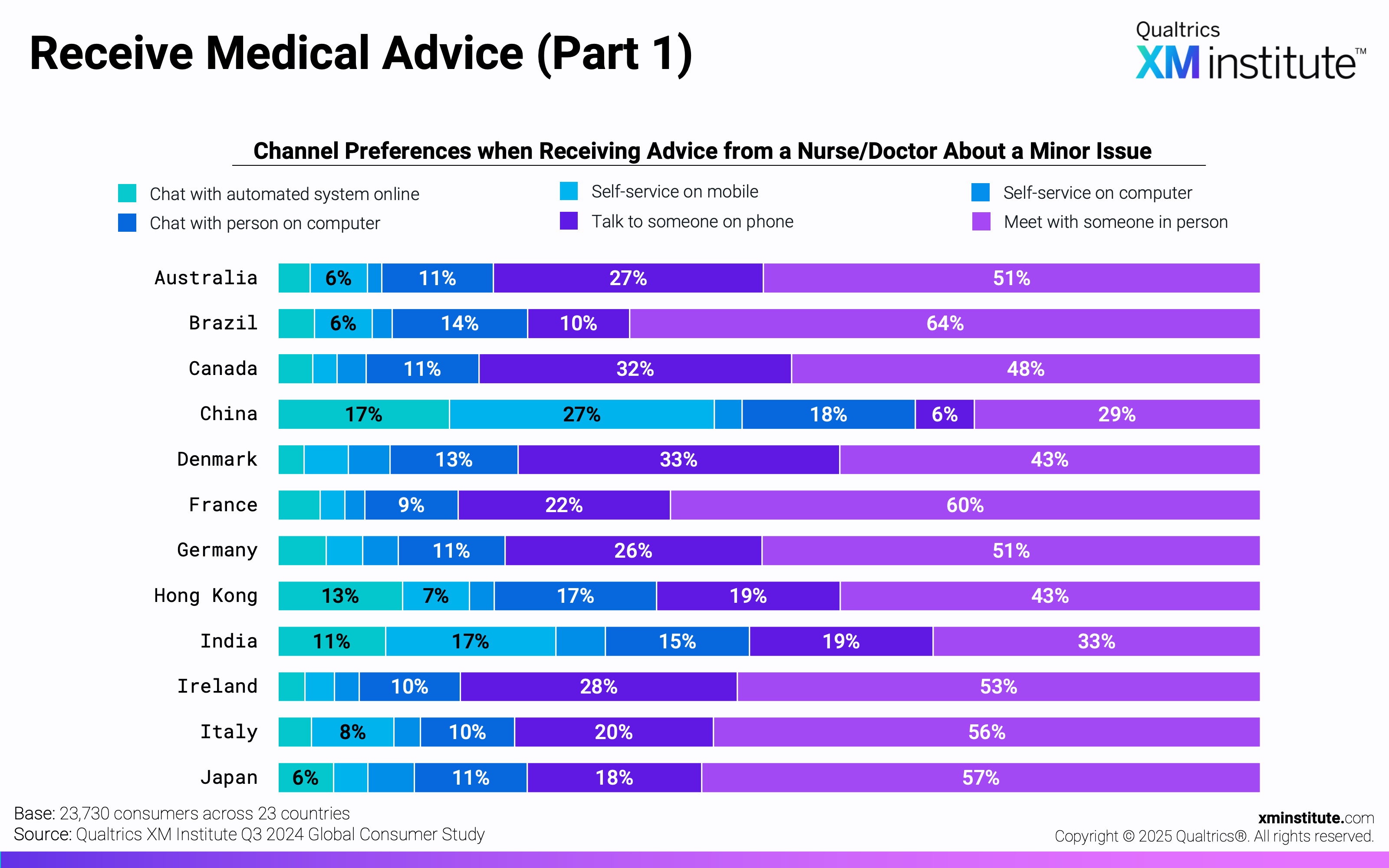

- Receive Medical Advice (Part 1) (see Figure 24)

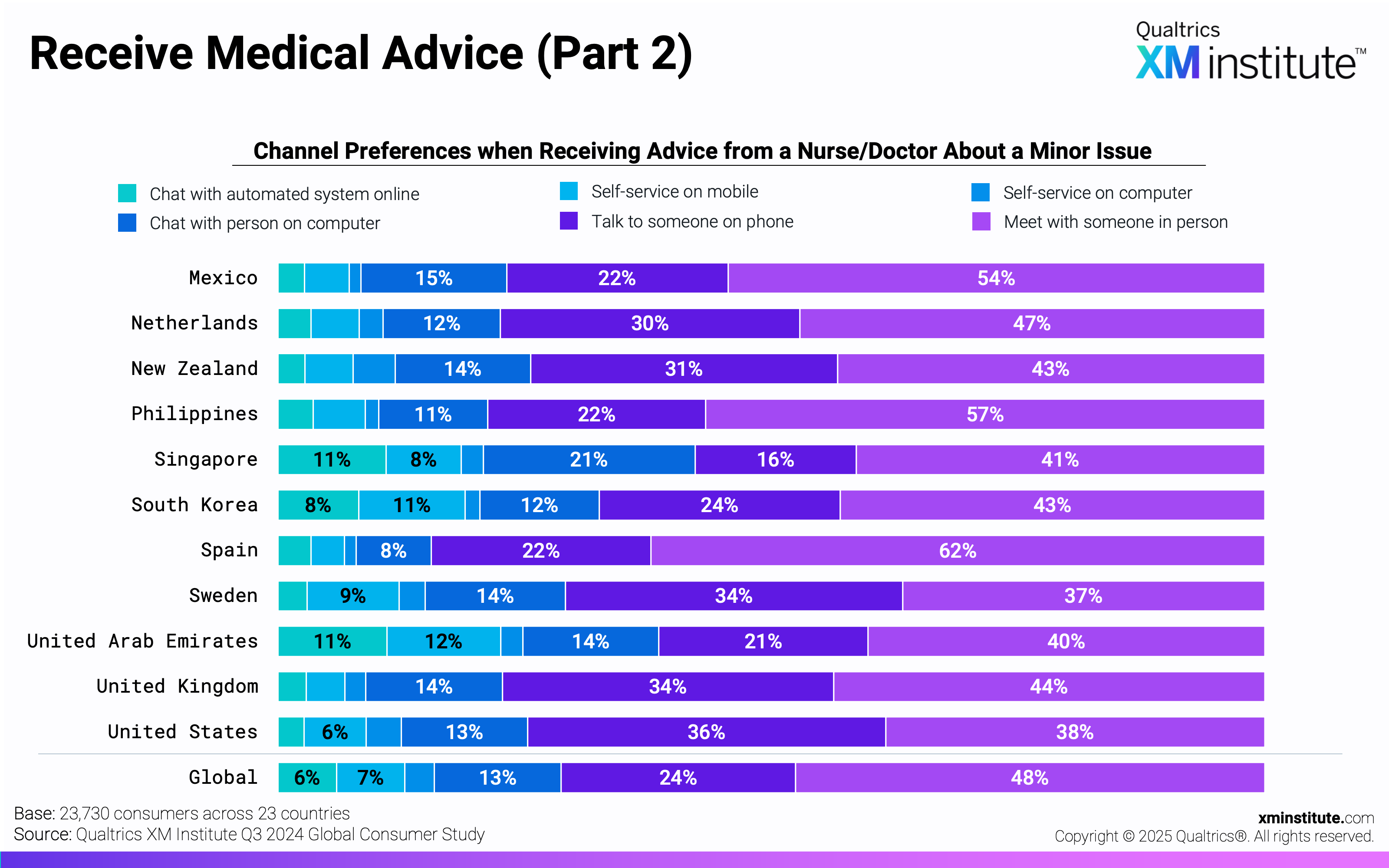

- Receive Medical Advice (Part 2) x (see Figure 25)

- Methodology (see Figure 26)